By Muhammad Ashraf Wani

ISLAMABAD, Jun 12 (APP): The coalition government on Wednesday unveiled its first Federal Budget for Fiscal Year 2024-25, presenting a comprehensive plan with a total outlay of Rs18.877 trillion.

Prioritizing fiscal consolidation, economic growth, and social welfare, the budget aims to lay the foundations for a sustainable, inclusive, and resilient economy, driven by a homegrown reform agenda.

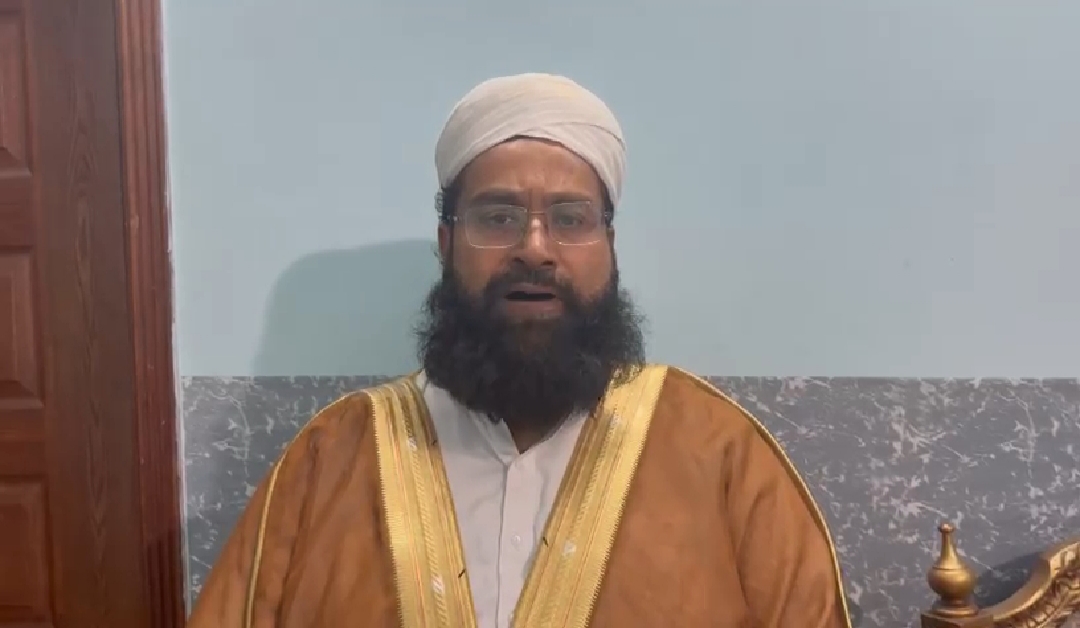

Finance and Revenue Minister, Senator Muhammad Aurangzeb, outlined strategic measures to boost revenues, fast-track privatization, and provide relief to vulnerable segments. Emphasizing collective responsibility and cooperation, he called for unity to implement economic reforms and urged prioritizing national interests above political differences.

Announcing relief measures, the minister announced a raise of 25 percent in salaries of employees from Grade 1-16 and 20 percent to Grade 17-22 employees to increase their purchasing power.

He said an increase of 15 percent has been proposed in the pension of retired employees. Likewise, the government increased the minimum monthly wage from Rs 32,000 to Rs 37,000.

The minister said the government aimed to transform the ‘government-determined economy’ into a market-driven economy, with a special focus on promoting exports and developing the base of the economy on savings and investment instead of consumption.

He said the private sector should be given crucial importance in taking forward the economy. He said that the GDP growth target for the fiscal year 2024-25 is set at 3.6 percent while the inflation rate is expected to remain 12 percent.

During the period, the budget deficit is estimated at 6.9 percent and the primary surplus at 1.0 percent. Giving the breakup figures of fiscal measures, the minister said that the Revenue collection by the Federal Board of Revenue is estimated at Rs12,970 billion, an increase of 38 percent when compared to the current fiscal year.

He said the non-tax revenue targets of the federation are fixed at Rs3,587 billion. The minister said, since the share of provinces would be Rs7,438, the net income of the federal government would be Rs9,119 billion. On the other hand, the total expenditures of the federal government have been estimated at Rs18,877 billion out of the total amount of Rs9,775 billion would be spent on interest payments.

The government has allocated Rs1,400 billion for the Public Sector Development Program (PSDP) in its current budget, adding that an additional amount of Rs100 billion would be allocated under Public-Private Partnership, bringing the total to Rs1,500, the highest in the country’s history.

He said, PSDP 2024-25 was focused on completing ongoing projects as 83 percent of resources are allocated for the completion of ongoing schemes and 17 percent for new development schemes.

He proposed an allocation of 59 percent resources for the development of infrastructure and 20 percent for social sector development.

The minister said that the government would provide Rs2,122 billion for defense, and Rs839 billion would be allocated for Civil Administration.

Meanwhile, an amount of Rs1,014 billion is also allocated for pension expenses and Rs1,363 billion for the subsidy of gas, electricity, and other sectors.

He said that despite the fiscal constraints, the government has enhanced its budgetary allocations, which would help to develop the volume of infrastructure including transportation, energy, IT, and water resources and improve the living standards of the people in the country.

He announced grants amounting to Rs1,777 billion for the promotion of the Benazir Income Support Programme (BISP), Azad Jammu and Kashmir (AJK), Gilgit-Baltistan, merged districts of KP, Higher Education Commission, Railways, and IT sectors.

To ensure equitable development in AJK, GB, and merged districts of the KP, the government has allocated at 10 percent and around 11 percent for other sectors development including IT, telecom, science and technology, governance, and production sector.

The government has included projects related to supporting the productivity of exports-oriented industries to enhance their competitiveness, to expand the digital infrastructure in the country.

He said the government was in negotiations with the IMF on Extended Fund Facility (EFF) to take forward its home-grown economic agenda aimed at bringing macroeconomic and fiscal stabilization, improving exchange reserves, improving governance in the power sector and State-Owned Entities (SOEs), and bringing transparency.

On fiscal consolidation, he said, a committee has been formulated to present its recommendations for curtailing the budget of the federal government adding efforts were on for right-sizing the federal government.

For promoting businesses, he said, the Pakistan Regulatory Modernization Initiative has been initiated to improve the business environment.

He said the government wanted to promote the private sector and would speed up the process of privatization.

The minister said that the beneficiaries of welfare programs have been increased from 9.3 million to 10 million to save these vulnerable families from the effects of inflation. In addition, one million children have been added to the education scholarship program bringing the total to 10.4 million.

He said for the promotion of economic inclusion and improving the economic situation of people, the government for the first time initiated poverty graduation and skills development.

The said Rs5 billion have been set aside for Markup and Risk Sharing Scheme for Farm Mechanization to promote financing, improve agriculture yield, and mitigate wastages.

He said, the government was paying special attention to the development of the transportation sector and was determined to further improve the network of roads and highways to strengthen the connectivity of cities to handle the increasing traffic volume.

The expansion of the infrastructure of energy and modernization was also a priority he said, adding the development of hydropower dams, solar plants installation, and transmission lines to ensure efficient distribution to tackle growing demands of energy.

Besides, he said that special attention would be paid to flood control, ensuring the supply of potable water through the construction of dams, improvising the irrigation system, and developing the water sanitation system through water resource management.

These projects would help develop infrastructure, improve transportation, energy, and overcome the challenges to achieve economic prosperity ultimately helping improve living standards of the citizens, the minister said.

In the PSDP, Aurangzeb said, for the next fiscal year, it was proposed to allocate Rs824 billion for infrastructure development, out of which an amount of Rs253 billion for the energy sector, Rs279 billion for transport and communication, Rs206 billion for the water sector development would be incurred.

He said that it was also proposed to allocate Rs 86 billion for Planning and Housing, and Rs280 billion for Social Sector Development, whereas an amount of Rs 75 billion for AJK and GB is also proposed in the budget.

The Finance Minister said that the government is also paying special attention to skill development and special allocations are made for this purpose, particularly to impart training to huge bulges of youth in the county to enhance employment opportunities.

Senator Aurangzeb said that a special package is proposed for the development of Karachi, as it was the mega city of the country and plays a vital role in the country’s economy, adding that it was a prerequisite to initiating a comprehensive program for modernizing the basic infrastructure of the city. The minister said that under the direction of the prime minister, to modernize the health infrastructure in Islamabad, Rawalpindi, AJK,KP and other areas, a comprehensive plan was devised to provide the latest and best medical services to the people of these areas.

In this regard, a proposal was received to construct Quaid e Azam Health Tower in the Pakistan Institute of Medical Sciences hospital to ensure the state of the art medical facilities to the people.

Announcing key principles of tax policy, the minister said the government wanted to broaden tax-base to improve tax to GDP ratio, digitalize un-documented economy and introduce progressive tax system to impose more tax on those earning more. He also announced a considerable increase in tax for transactions for non-filers.

The minister proposed tax relaxation on import of raw materials for solar panel and aquaculture industry in the country.

Aurangzeb said the government, in order to promote the local manufacturing of solar panels, had decided to provide tax relaxation on the import of plant, machinery, raw materials and parts used in the manufacturing of solar panels, inverters and batteries.

Similarly, he said the government had also proposed to offer tax relaxation on the import of feed and seed for the growth of fishes and lobsters to promote the aquaculture industry in the country.

Besides the government has also proposed to provide tax incentives on the import of farming, breeding, feed mill and processing units for the aquaculture industry.

Meanwhile, the finance minister proposed to end tax exemption on import of hybrid and luxury electric vehicles.

Regarding sales tax measures for FY25, the finance minister announced the government’s plan to remove various exemptions and zero ratings while adjusting rates.

Mobile phones will now be taxed at the standard rate, except those valued over US$ 500, which will remain at 25%.

Additionally, the sales tax for POS retailers dealing in leather and textile products will increase from 15% to 18%.

Iron and steel scrap will be exempt from sales tax, and exemptions for ex-FATA/PATA regions will be phased out. Petroleum products’ zero-rating will shift to exemption, and default surcharge rates will align with the SBP’s policy rate.

Corporate Income Tax reforms from 2019 to 2023 have been implemented, and now Personal Income Tax reforms are on the agenda to align with international standards.

Tax exemptions up to an annual income of Rs 600,000 will be retained, with no proposed increase in the maximum tax slab for salaried individuals.

However, five taxable slabs ranging from 5% to 35% are introduced for non-salaried individuals. Late filers will face a new tax rate, higher than filers but lower than non-filers, to incentivize timely filing. Progressive tax rates for immovable properties will vary for filers, late-filers, and non-filers, ranging from 3% to 20% depending on property value brackets.

The finance minister outlined several proposed budgetary measures for FY 2024-25 regarding Federal Excise Duty (FED).

These include imposing FED on acetate tow at Rs. 44,000, FED on nicotine pouches at Rs. 1200 per kg, and increasing FED on e-liquids. Additionally, FED rates of Rs. 15 per kg on sugar supplied to manufacturers, Rs. 2 to Rs. 3 per kg on cement, and 5% on commercial properties and first sale of residential properties have been proposed.

Furthermore, there’s a proposal to enhance the FED rate on filter rods from Rs. 1500 per kg to Rs. 80,000 per kg.